Drivers of Economic Recovery

The economic recovery has been a central topic for our latest book Aftershocks and Opportunities – Scenarios for a Post-Pandemic Future (published June 1st), the associated Launch Summit, and our regular Sunday evening webinars. What’s clear is that the picture could differ significantly from nation to nation. Across the book chapters and webinars, there has been a lot of discussion about the overall shape and nature of the economic recovery, the underlying factors that could play the most significant influencing role for different countries, and the scenarios that could result. Here we provide a short overview of each of these elements.

Shape of the recovery – The decline in GDP has been predicted to reach up to 6% globally, with a fall of up to 40% in the worst hit nations, and contractions of 10-30% in the more developed economies. Many government leaders around the world have argued passionately that the bounceback will be just as strong – with a V shaped recovery curve. Others suggest that the period at the bottom of the curve could last longer – giving rise to a U shaped recovery curve.

Some are suggesting that the downturn could be longer and deeper – turning into an elongated U or L shaped curve – the latter apparently having no recovery path for the foreseeable future. The most common view is that many countries could be looking at an initial bounceback, followed by a decline, and then potentially a series rises and declines until there is eventually enough commitment, momentum, and government support to sustain the rise back out – giving a potential W, WW, or WWW shaped recovery.

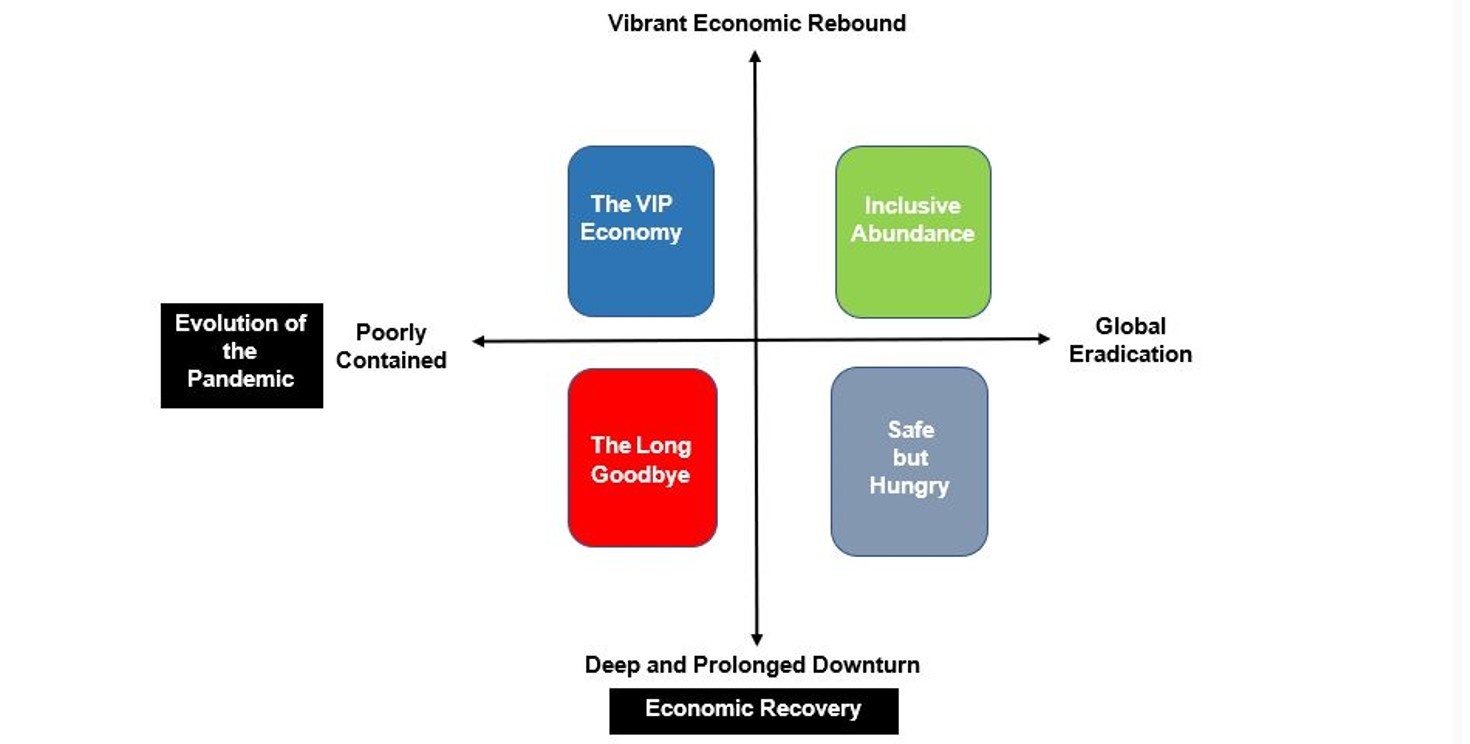

Baseline scenarios – The opening chapter of the book examines four possible scenarios for how these factors could come together and how different economies could evolve as a result in the next 2–3 years. The four scenarios could play out globally and at national level – with different countries being in each scenario at the same time:

- The Long Goodbye (poorly contained pandemic, deep and prolonged downturn)

- The VIP Economy (poorly contained pandemic, vibrant economic rebound)

- Safe but Hungry (eradication of the pandemic, deep and prolonged downturn)

- Inclusive Abundance (eradication of the pandemic, vibrant economic rebound)

The critical underlying forces identified as having the most relevance in determining the possible paths to recovery include:

Consumer spending – In the relatively near term as the lockdown lifts, we will get a sense of the scale of the spending recovery and how long it might last. What’s critical here is that while many have had their incomes savaged, across different countries somewhere between 30-70% of people haven’t had their incomes affected at all and their behaviour will be key. Many will be tempted in by retailers offering deep discounting in summer sales to make up for lost revenues in the lockdown. If the resulting initial burst of activity is followed by sustained consumer spending, this could drive business confidence and accelerate the path out of the downturn. However, any signs of nervousness could spread rapidly and have a dampening effect.

Employment – The extent to which furloughed jobs are reinstated or turn into redundancies is critical here – alongside the return to employment of those made redundant during lockdown. In April, the International Labor Organization estimated that lost working hours worldwide equated to 305 million jobs and warned that up to half the global workforces was at risk. There are also concerns that, in many countries, these losses seem to be disproportionately impacting women, minorities, and those on the lowest incomes.

The picture varies worldwide, for example, having lost over 40 million jobs to COVID-19, the US is experiencing signs of hope, with 2.5 million new jobs being added in May 2020. In the UK, around 8.7 million are furloughed and up to 2 million of these jobs are considered at risk, alongside hundreds of thousands of self-employed workers and small firm owners whose businesses may not return.

Savings rates – The level of uncertainty over jobs and incomes and the extent to which that drives people to save are both being monitored closely. Savings levels have indeed risen in several places. Many governments and central banks have looked at the idea of negative interest rates as a way of positively discouraging savings and influencing citizens to spend instead. This drives associated concerns over the potential for inflation and people being left with no financial security blanket.

Business recovery – Close attention is being paid to how the most affected businesses bounce back and whether this drives job creation or further redundancies. Some countries are anticipating up to 40% failure rates as firms discover that they are no longer viable – particularly with social distancing rules in effect. Major firms from airlines to oil companies and financial services are already starting to announce worldwide job cuts – which could further dampen consumer spending.

Sectors such as hospitality, entertainment, travel, aviation, and tourism are seen as particularly vulnerable. The question here is what the impact might be of government stimulus investments and private investment in new science and technology growth sectors – and how quickly they might come through. The risk is one of a skills mismatch between those losing their jobs and the new opportunities emerging.

Business budgets – The level of business spending and investment as we come out of lockdown will be central – as it is in every economic downturn. The recovery is very reliant on optimistic businesses that are willing to commit to investments, maintain operating budgets, and continue hiring. The risk is that lower expense budgets and delayed investments in both 2020 and 2021 will have deep knock on effects across the economy. A natural reaction for firms seeing declining order books is to put a brake on their own spending – which then ripples through their own supply chains. A key factor here will also be the access to capital and in particular bank lending. Any reluctance to lend could have a very clear and rapid dampening effect on economic recovery.

Automation – A trend towards business automation and adoption of artificial intelligence was already underway prior to the pandemic. The lockdown has seen an acceleration, with a particular focus on deploying physical robots, the use of robotic process automation of many administrative tasks, and generally removing human involvement in service roles – driving the growth on contactless and paperless processes in everything from airports to retail. Such developments could improve efficiency and profitability, create new specialist roles for those devloping and deploying the solutions, but potentially drive higher unemployment due to job displacement.

Retraining – Major job opportunities are emerging in new sectors. These require people to be retrained into the required skills – the speed at which this can happen will be crucial. There are clear questions over who funds such training – with many areguing that for governments, the short term retraining costs would be greatly outweighed by the long term savings on unemployment benefits and the inflow of new incomes taxes.

Government spending and action – Perhaps the single biggest factor of all will be how governments choose to steer the recovery and handle the costs of the health and economic emergency. From unemployment benefits and healthcare to education and infrastructure – the pressure will be on governments to spend and invest heavily to drive economic activity, build business and consumer confidence, and encourage banks to lend more readily. Hence, some governments may look to spend their way out of the downturn.

A government spending led recovery could see major investment in physical and digital (e.g. broadband) infrastructure, business support, R&D programmes, green growth initiatives, and training and education at every level. This could extend to heath and care systems, and enhanced preparedness in resilience and contingency preparation for future health and environmental shocks. Funding this will require some mix of debt, quantitative easing / the printing of money, and public-private finance initiatives. All of this would be predicated on the hope that growth will deliver the necessary tax revenues to pay the interest bill and start chipping away at the levels of accumulated debt.

Concerns will grow over nations with the most precarious of economies and the long term social, economic, and environmental cost of any deals they might sign with those willing to bail them out. Of course, some may decide that the markets must take care of themselves and focus instead on austerity measures designed to reduce the scale of debt and associated interest payments. The extent to which the wealthiest nations and donors might collaborate to support those in most need will have a crucial bearing on the extent to which a truly sustainable global recovery can be affected.

Image credits:

Image 1: https://pixabay.com/illustrations/trend-curve-hand-presentation-euro-1445464/

Image 2: Fast Futuer Publishign

Image 3: https://pixabay.com/photos/china-town-singapore-market-2392265/

Image 4: https://pixabay.com/photos/piggy-bank-money-cow-dollar-bill-1510525/

Image 5: https://pixabay.com/photos/architecture-building-businessman-1850732/

Image 6: https://pixabay.com/photos/battleship-engine-room-historic-war-389274/