FutureScapes March 9: Foray into the Future

Welcome to the latest edition of FutureScapes. Today we take a look at some of the global drivers of change that may have a hand in shaping the future over the next decade and beyond. Specifically, we focus on economic, policy and governance drivers, and shifts in economic systems.

In this issue:

- Writings on the Future: Drivers of Change

- Futures Finds in Media

- Fast Future Publishing Updates & Offers

As always, please feel free to share this newsletter with friends and colleagues, and send us an email if you’d like – feedback is always welcome.

Writings on the Future: Drivers of Change – Section One

By April Koury, Iva Lazarova and Rohit Talwar from The Future of Business

You can also listen to this chapter on The Future of Business Podcast on iTunes, our RSS feed, or our YouTube Channel.

Policy and Governance

Rate of Democratic Transition – As one regime after another toppled in the wake of the Arab Spring, expectation rose that more nations would move to a democratic form of government either through conflict or peaceful means. Now, however, the resulting difficulties of adopting a democratic model have highlighted the capacity building challenges and the hurdles inherent in transforming governmental and social structures in such a short time frame.

Reframing of Global Governance Institutions – The global shifts of wealth, power, and influence toward the emerging economic giants is driving demand for the restructuring of global institutions like the United Nation, the World Bank, and the International Monetary Fund. Power will continue to flow to the populous and increasingly economically strong nations – led in particular by China, India and Brazil. New alliances and groupings will form such as the Shanghai Co-operation Organization and ASEAN (Association of Southeast Asian Nations) and they will seek to increase trade and political ties, bypassing the West in many cases.

Democracy 2.0 – The rise in digital technology has given many citizens easier access to governments – who in turn have greater access to the thoughts, opinions, needs, and wants of all citizens in a flexible, adaptable, and real time manner. Individual citizens can increasingly be consulted on any matter and are able to bring their issues to government attention.

Country Mergers – Many governments will struggle to finance everything they are expected to by their citizens, from policing and social welfare, to education, climate change protection, and economic development. The map of the globe will change, driven by economic and environmental forces. Many smaller and poorer countries may find it impossible to cope on their own with the accelerating pace of change and the cost of keeping up to speed with a globally connected planet. By 2025, we could see 20-25 country mergers, with “at risk” nations seeking to come together to create the critical economic strength and attract the investment required to serve their populations and compete in the hyperconnected era.

Country Fissions – New countries could also emerge. Since 1945, the number of countries worldwide has grown from 60 to 196 today. New states developed with decolonization in the 1960s and 1970s, and even more gained sovereignty with the break-up of the USSR. Now, Catalonia, Brittany, Scotland, the Western Sahara, sections of Myanmar, Iraq, Syria, Libya, and even Saudi Arabia are among the many regions today that could break apart and form new nations in the next two decades. Alongside country mergers, we may also face a future of an increasing number of smaller, independent nations.

Neo-Cold War – Tension could increase between Russia and Europe / the U.S., particularly if Russia’s economic situation declines further and it continues to seek to annex former parts of the Soviet Union. A new cold war between China and the U.S. / Europe could arise if China is seen to become too strong economically and to be pursuing a global political stance that goes against the western nations’ wishes. Additionally, the proliferation of nuclear, biological, and chemical weapons could introduce new state players into this situation.

Rise of Brutal Fundamentalism – A growing number of fundamentalist groups may emerge from a variety of religions and worldviews as their leaders seek to pursue religious, political, social, and economic ambitions through the bullet rather than the pulpit or ballot box. Governments and global institutions will struggle to respond effectively because of the lack of desire to engage in ground conflict and the increasingly outdated notion of outright victory in such conflicts.

Networking and Automation of the World’s Legal System – While world law may not exist in the foreseeable future, the world’s legal systems are expected to become increasingly networked. This could lead to ever closer alignment of legal frameworks and the increasing automation of the law as it becomes embedded in our environment – for example vehicles that automatically fine us if we exceed the speed limit.

Political Experimentation – Worldwide, there is a growing view that current governance models simply are not appropriate for a world in transition in the digital age. Democracy, single party states, dictatorships, and monarchic rule are being scrutinized as governments experiment to see which new models can best serve national goals. In increasing instances where the government has been viewed as utterly ineffective, citizens have joined together to solve problems that were traditionally handled by the government.

Empowered Populations – New models of government coupled with technology advances are empowering populations to share knowledge, be aware of their environment, and make informed and responsible decisions. One challenge to leveraging all of this data and information is the ever growing shortage of data scientists. However, these empowered communities are still able to challenge the roles of the decision makers currently running politics, health, education, and welfare systems.

Civic Hacktivism – Civic hacktivism is the combination of civic activism and the digital world. Civic hacktivists use their coding and computer programming know-how to replace slow, outdated government bureaucracy with fast, usually internet-based solutions. By networking citizens, governments, and technologists together, local problems can be discussed, ideas brainstormed, and apps developed which solve the initial problems. By streamlining government bureaucracy, citizens are better able to understand and participate in their local governments, and governments are made more transparent and accountable to their constituents.

Rise in E-Government – Globally, countries are pushing for more e-government projects in order to cut costs and improve internal communication, as well as to gain a better understanding of – and provide services to – their citizens. These initiatives are already changing the way businesses and citizens interact with, and access, government services.

Privatization of Public Services – Worldwide, governments are increasingly turning to the private sector to deliver public goods and services. Often commercial providers are more efficient, cheaper, and have a quicker response time than government-run public services. However, when an increasing number of public services are delivered by the private sector, questions around governance, transparency and risk emerge.

Economics

Economic Growth – Despite economic uncertainty and systemic fragility, economic growth (global GDP) is expected to continue growing into the next decades. According to projections, the global economy is expected to grow at an average rate of over three percent per year from 2011 to 2050, doubling in size by 2030, and again by 2050.

Public Debt – Public debt is the total amount owed by a central government to its creditors. The global financial crisis and the Eurozone sovereign debt crisis have both left developed economies with high levels of indebtedness. Total debt for OECD has risen from 79.9 percent of total OECD GDP in 2008 to 111.2 percent in 2014 according to OECD figures.

Economic Power Shifts – Emerging economies are experiencing growth, allowing them to exert more influence over the global economy. This shift in power may lead to the rise of a new international system. Leading the way for the last decade were the growing economic juggernauts of Brazil, Russia, India, China and – to a lesser extent – South Africa. Potentially following in their wake are the so-called “Next 11” countries – Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, South Korea, Turkey, and Vietnam. These are identified as having the potential to become some of the world’s largest economies in this century.

Global Flows – As the world becomes more interconnected, the flow of goods, services, people, and finance across borders continues to grow. These global flows represent over 36 percent of global GDP and are creating new degrees of interconnectedness between countries. The degree of connectedness of a nation is seen as an indication of its current and potential prosperity. It is estimated that countries with a larger number of connections in the network of global flows increase their GDP growth by up to 40 percent more than less connected countries.

Feminomics – In both developed and emerging markets, by 2020 roughly one billion women who had been living at a subsistence level will enter the global economy for the first time – as middle class consumers, producers, entrepreneurs, and employees. They will have roughly as much economic influence as the populations of India or China. Governments will need to address any gender-based discrimination that may arise. Businesses will need to reassess not only what goods and services to provide these new consumers, but also how to meet the needs of these new employees.

New Trading Zones – Worldwide, governments are entering into new trade agreements, which in turn will stimulate the development of new trading hubs, creating new growth markets and increasing trade volumes by 2020.

Global Inequality – Over the past 20 years, global inequality has increased dramatically, a trend expected to continue into the future. In 2014, Oxfam reported that 85 of the world’s wealthiest individuals had a combined wealth equal to that of the bottom 50 percent of the world’s population, or about 3.5 billion people. It is projected that by 2016, the wealthiest one percent will own more than half of all global wealth. Research indicates that greater income inequality within countries correlates with higher unemployment and crime rates, and lower than average health and social mobility.

Continued Globalization – As the world shrinks through transport improvements and ever faster communications technology, so the flows of goods, services, people, and capital moving between nations and across continents continues to increase. While globalization tends to lead to market liberalization and expand trade in most countries, concerns arise over the additional levels of complexity it adds to business decision making and the potential for cultural dilution.

Technological Long-Term Unemployment – By 2025, it is estimated that up to 50 percent of current jobs at every level will be replaced by software, robots, or smart machines. As more jobs are automated, fewer are being created by the emerging sectors; those that are created require higher skills and fewer people. This could result in long-term unemployment, placing massive pressure on governments, businesses, and society to rethink business policies. It will also force a re-evaluation of approaches to education, lifelong learning, job creation, and job placement assistance. Long-term unemployment would strain government social security budgets, lead to a rise in poverty, and drive the expansion of the shadow economy as people seek to work outside of the tax system.

Economic Systems

Systemic Fragility – The global financial crisis of 2008 illustrated just how fragile and interconnected today’s global operating environment is. Every aspect of finance, government, and commerce was affected by this systemic fragility. This growing sense of risk is driven by continued economic volatility, continuing rich-poor divides, the complexities of financial markets, declining government spending, the disruptive impact of crowd financing, and cybercurrencies, increasing polarities between political groups, and the demand for truly sustainable infrastructure investment and resource allocation.

Systemic Antifragility – Risk analyst Nassim Taleb introduced the concept of antifragility to systems thinking, with the idea that a system improves as it is exposed to stress. While a rigid system may seem more stable, in the long run it is unable to cope with unexpected shocks. Conversely, an antifragile system contains built in redundancies that help it thrive and adapt to changing forces and pressures. Governments and businesses are exploring antifragility concepts to develop better policies and regulations concerning financial systems in particular.

Networked Economy – The networked economy is the emerging economic environment that is driven by the massive, multilayered, exponentially-growing, real-time connections between people, devices, and businesses. It is the convergence of social networks, business networks, and the network of devices connected to the Internet of Things. SAP estimates that the networked economy will be valued at $90 trillion over the next 10 to 15 years. To adapt to the new economy, businesses will need to become mobile, social, and “always connected” to both internal and external business and social networks. Because the networked economy hinges on information, companies will need to address issues concerning the ownership, privacy, and security of that information.

Global Derivatives Market – The global derivatives market is an integral part of the international finance system and global economy. Worldwide, businesses use derivatives to hedge risks and reduce uncertainty about future prices. Defaults on sub-prime mortgages, a type of financial derivative instrument, partially triggered the last global financial crisis. Most financial derivatives are not traded on any exchange and so total exposure is difficult to determine. Estimates vary greatly – and some suggest the face value of all derivatives outstanding is over three quadrillion (3,000 trillion) dollars, or more than 40 times the entire world’s annual GDP.

Full Reserve Banking – Full reserve banking only allows banks to lend out the assets they actually hold. This is the alternative to the dominant fractional reserve banking system, which many believe has created unmanageable instabilities in the global economy that will drive future economic collapses. Full reserve banking requires that banks keep the full amount of depositors’ funds at all times, and that they may only lend out the actual assets they possess. Some economists argue that full reserve banking is more robust and less liable to create the types of credit bubbles, systemic risk, or “too big to fail” scenarios that occur under fractional reserve banking.

Technological Hegemony – Countries with ownership of core technologies typically enjoy higher levels of added value as a result. Hence a country’s science and technology development level could decide its status in the international arena.

Socio-Economic Unrest – With debt issues unresolved and a hyper-volatile global economy, the potential for further downturns is very real. The costs of recovery could see further redundancies and austerity measures similar to those experienced in Greece. Populations may not be willing to put up with this while others continue to make disproportionate gains in wealth, further widening the gap between rich and poor.

Governing the Shadow Economy – The shadow economy exists alongside a country’s official economy, and consists of illicit economic activities like undeclared work and black market transactions that avoid government regulation, oversight, and taxation. Current estimates place the annual market value of the global shadow economy at $1,829 billion. Many countries who once tried to control the shadow economy are now moving toward a model of acceptance, acknowledging that in some instances it can deliver many of the services governments are failing to provide, such as policing, education, and healthcare.

Futures Finds in Media

Steve Wells in the media

Our own Steve Wells, Head of Operations and Author Liaison, has been making the rounds and discussing the future of business.

- BBC WM 95.6 – an interview about the driverless convoys, the implications for truckers, and techonological unemployment.

- BBC Radio 5 – again Steve touches on driverless lorries & smart automation taking over jobs, including blue collar professions.

- Robot Overlordz episode 249: Future Bizness – Steve sat down with the guys from Robot Overlordz to discuss The Future of Business. Also check out episode 250 where they talk more about how much they like the book.

Rats vs. computers vs. rat cyborgs in maze navigation via Kurzweil News

The intelligent rat ‘cyborgs’ beat both the computers and the rats. The conclusion: “…optimal intelligence may reside in the integration of animals and computers.”

The intelligent rat ‘cyborgs’ beat both the computers and the rats. The conclusion: “…optimal intelligence may reside in the integration of animals and computers.”

“People will fall for it like a drug”—Game devs on the future of VR via ars technica

Will VR ever live up to its hype, or is it simply too much for the average consumer? Game developers throw in their two cents.

Will VR ever live up to its hype, or is it simply too much for the average consumer? Game developers throw in their two cents.

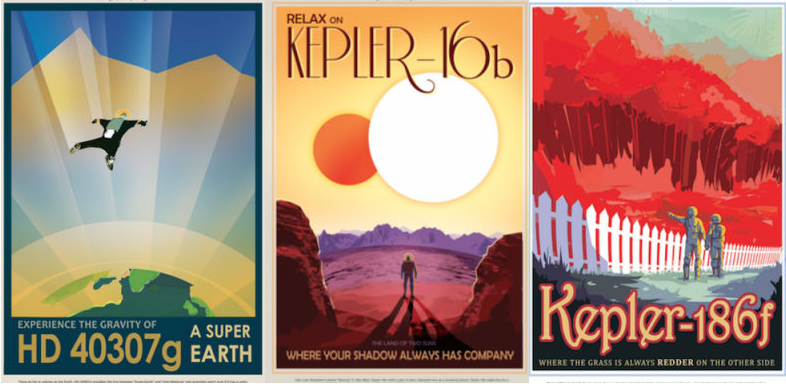

We’re Entering a Golden Age of Space Tourism Propaganda via GIZMODO

In case you’ve missed them, SpaceX and NASA have both put out gorgeous, retro-inspired travel posters. With propaganda this beautiful, who wouldn’t want to go?

In case you’ve missed them, SpaceX and NASA have both put out gorgeous, retro-inspired travel posters. With propaganda this beautiful, who wouldn’t want to go?

We may all happily follow our robot overlords to disaster via ars technica

How much do we trust robots? In this study, participants willing followed a labeled rescue robot they knew was malfunctioning. Perhaps it’s not how much we trust robots, but how much we believe in labels…

How much do we trust robots? In this study, participants willing followed a labeled rescue robot they knew was malfunctioning. Perhaps it’s not how much we trust robots, but how much we believe in labels…

Will Electric Vehicles be 35% of New Car Sales Globally in 2040? via WFS

“…electric vehicles (EVs) will achieve 41 million unit sales by 2040 and 35% of new light duty vehicles. That’s an increase of 9,000% over current unit sales which reached 462,000 in 2015.” A bit of a look into the possible scenarios that could play out based on the recent report released by Bloomberg New Energy Finance.

“…electric vehicles (EVs) will achieve 41 million unit sales by 2040 and 35% of new light duty vehicles. That’s an increase of 9,000% over current unit sales which reached 462,000 in 2015.” A bit of a look into the possible scenarios that could play out based on the recent report released by Bloomberg New Energy Finance.

YouTube as Motivator – what people can do with their basic incomes via IEET

Basic income – without the incentive of financial gain, will anything get done? On the contrary: “…YouTube to me is a window into a post-basic income world full of intrinsic motivation, where video after video is made for the love of making and sharing videos with those who enjoy watching them.”

Basic income – without the incentive of financial gain, will anything get done? On the contrary: “…YouTube to me is a window into a post-basic income world full of intrinsic motivation, where video after video is made for the love of making and sharing videos with those who enjoy watching them.”

Updates & Offers

Because we’ve had such great success with our Future Day Sale, we’ve decided to extend the offer until the end of March. Check out our website to pick up a copy of The Future of Business for 65% off (coupon code FutrDay), and take 20% off all other books in our store (coupon code 20Futr). And thank you for your support!